Use these links to rapidly review the document

Table of Contents

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ý Filed by a Party other than the Registrant o

Check the appropriate box:

| Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

Definitive Proxy Statement | ||

o | Definitive Additional Materials. | |

o | Soliciting Material Pursuant to Section 240.14a-12 |

| HD SUPPLY HOLDINGS, INC. | ||||

(Name of Registrant as Specified in Its Charter) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount previously paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

31003400 Cumberland Boulevard, Atlanta, Georgia 30339

March 31, 201730, 2018

Dear Stockholder:

It is my pleasure to invite you to attend HD Supply Holdings, Inc.'s annual meeting of stockholders to be held at 11:00 a.m. (Eastern Daylight Time) on May 17, 2017.2018. The meeting will be held at HD Supply's headquarters, located at Cumberland Center II, 31003400 Cumberland Boulevard, Atlanta, Georgia 30339.

The accompanying notice of meeting and proxy statement contain important information, including a description of the business that will be acted upon at the meeting, as well as the voting procedures and general information about the meeting. At the meeting, management will be available to respond to any questions you may have regarding the Company's performance and operations or to other questions you may have.

Your vote is important. Whether you plan to attend the annual meeting or not, you may access electronic voting via the Internet, which is described on your enclosed proxy card, or, if you received a proxy card by mail, you may sign, date and return the proxy card in the envelope provided. If you plan to attend the annual meeting you may vote in person. Returning the proxy does not deprive you of your right to attend the annual meeting and vote your shares in person for the matters acted on at the meeting.

Registration and seating will begin at 10:00 a.m. (Eastern Daylight Time). Each stockholder will be asked to present an admittance ticket (the Notice of Internet Availability that you received by mail) and valid government-issued picture identification. Stockholders holding stock in brokerage accounts will need to bring a copy of a brokerage statement reflecting stock ownership as of the March 20, 201721, 2018 record date. Cameras and recording devices are not permitted at the meeting. All bags, briefcases, and packages will be held at registration and will not be allowed in the meeting.

Thank you for your support of HD Supply. We look forward to seeing you at the annual meeting.

| Sincerely, | ||

/s/ JOSEPH J. DEANGELO | ||

Joseph J. DeAngelo Chairman, President and Chief Executive Officer |

![]()

31003400 Cumberland Boulevard, Atlanta, Georgia 30339

NOTICE OF 20172018 ANNUAL MEETING OF STOCKHOLDERS

| Date and Time: | Thursday, May 17, | |||

Place: | HD Supply's headquarters, located at | |||

Record Date: | March | |||

Who May Vote: | Stockholders as of the close of business on March | |||

Items of Business: | 1. | To | ||

2. | To elect as directors the four persons nominated by the board and named in this proxy statement; | |||

3. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending | |||

4. | ||||

To transact any other business as may properly come before the Annual Meeting. | ||||

A copy of this proxy statement and our annual report on Form 10-K for our fiscal year ended January | ||||

To attend the meeting in person, please bring your admittance ticket (the Notice of Internet Availability of Proxy Materials that you received by mail), proof of your share ownership as of the record date (such as a brokerage statement), and government-issued photo identification (such as a driver's license). | ||||

A Notice of Internet Availability of Proxy Materials or this proxy statement is first being mailed to stockholders on or about March | ||||

Date of Mailing: | March 30, 2018. | |||

Your vote is important. Please vote as soon as possible via the Internet or, if you received a proxy card by mail, by signing and returning the proxy card. Instructions for your voting options are described on the proxy card.

| By Order of the Board of Directors | ||

/s/ DAN S. MCDEVITT | ||

Dan S. McDevitt General Counsel and Corporate Secretary |

Atlanta, Georgia

March 31, 201730, 2018

GENERAL INFORMATION ABOUT THE | 1 | |

OUR EXECUTIVE OFFICERS | ||

OUR BOARD OF DIRECTORS | ||

GOVERNANCE OF OUR COMPANY | ||

Selecting Nominees for Director | ||

Board Refreshment | ||

Director Independence | ||

Executive Sessions of our Non-Management Directors | ||

Board Self-Evaluation Process | ||

Board Leadership Structure | ||

Board's Role in Risk Oversight | ||

Corporate Governance Guidelines, Committee Charters and Code of Business Conduct and Ethics | ||

Committees of the Board of Directors | ||

Compensation Committee Interlocks and Insider Participation | ||

Compensation Practices and Risk Management | ||

Meetings of the Board of Directors and Attendance at the Annual Meeting | ||

Succession Planning and Management Development | ||

Policies and Procedures for Related Person Transactions | ||

Related Person Transactions | ||

Communicating with our Board of Directors | ||

Policy Regarding Certain Transactions in Company Securities | ||

OWNERSHIP OF SECURITIES | ||

DIRECTOR COMPENSATION | ||

| ||

| ||

Narrative Discussion | ||

| ||

EXECUTIVE COMPENSATION | ||

Compensation Discussion and Analysis | 38 | |

Summary Compensation Table | ||

Pay Ratio Disclosure | 55 | |

Grants of Plan-Based Awards Table | ||

Outstanding Equity Awards Table | ||

Option Exercises and Stock Vested Table | ||

Pension Benefits and Nonqualified Deferred Compensation | ||

Potential Payments Upon Termination or Change in Control | ||

COMPENSATION COMMITTEE REPORT | ||

AUDIT COMMITTEE REPORT | ||

AUDIT MATTERS | ||

Principal Accounting Firm Fees | ||

PROPOSAL 1 — AMENDMENT OF THE CERTIFICATE OF INCORPORATION AND BYLAWS TO DECLASSIFY BOARD OF DIRECTORS | 67 | |

PROPOSAL 2 — ELECTION OF DIRECTORS | 69 | |

PROPOSAL | ||

| 71 | |

| ||

| ||

OTHER INFORMATION FOR STOCKHOLDERS | 72 | |

Section 16(a) Beneficial Ownership Reporting Compliance | ||

Solicitation of Proxies | ||

Stockholder Proposals or Stockholder Nominations for Director at | ||

| ||

Other Business | ||

| ||

|

GENERAL INFORMATION ABOUT THE |

HD SUPPLY HOLDINGS, INC.

31003400 Cumberland Boulevard, Atlanta, Georgia 30339

This summary highlights information contained elsewhere in this proxy statement. It does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

20172018 Annual Meeting Information:

| Date: | ||

| Time: | 11:00 a.m. Eastern Daylight Time | |

Location: | HD Supply's headquarters, located at | |

Record Date: | March | |

Admission: | To attend the meeting in person, you will need your admittance ticket (the Notice of Internet Availability of Proxy Materials that you received by mail), proof of your share ownership as of the record date (such as a brokerage statement), and government-issued photo identification (such as a driver's license). |

| Proposals | Board Vote Recommendation | Page Reference (for more information) | ||||

|---|---|---|---|---|---|---|

| 1. | FOR | |||||

| | | | | | | |

| 2. | Elect four directors nominated by the board | FOR ALL | 4-5, 10-12, 69-70 | |||

| | | | | | | |

| 3. | Ratify the appointment of our independent registered public accounting firm | FOR | 6, | |||

| | ||||||

| | | | | | | |

| | |

| | |

| | HDS Notice of Annual Meeting and |

GENERAL INFORMATION ABOUT THE |

20162017 Company Performance Results

Despite a challenging year, HD Supply Holdings, Inc. (the "Company") achieved the following strong performance results in fiscal 2016:2017:

In addition to the above performance highlights, the Company accomplished significant debt reduction and ongoing interest savings objectives during the year. We refinancedIn December 2017, we reduced the U.S. borrowing capacity on our $1,000Senior ABL Facility by $500 million. In September 2017, we used a portion of the net proceeds from the sale of our Waterworks business to redeem all of the outstanding $1,250 million aggregate principal 11.5% October 2012of our 5.25% Senior UnsecuredSecured First Priority Notes due 2020 with $1,000 million aggregate principal 5.75%2021. In April 2016 Senior Unsecured Notes due 2024. In October 2016,2017, we refinanced our $1,275 million aggregate principal 7.5% February 2013 Senior Unsecured Notes with proceeds from issuance of $550 million aggregate principal term loans, availableused cash and available borrowings under the Senior ABL Facility.Facility to repay $100 million aggregate principal of our Term B-1 Loans. Debt refinancing activities in fiscal 20162017 will reduce cash interest payments by approximately $122.5$75 million annually.

The Company supplements its reporting of net income with non-GAAP measurements, including adjusted EBITDA, adjusted net income (loss), adjusted net income per diluted share and net debt. This supplemental information should not be considered in isolation or as a substitute for the GAAP measurements. Additional information regarding adjusted EBITDA, adjusted net income and adjusted net income per diluted share referred to herein, including a reconciliation, if available, to the most comparable GAAP measure, is included under Management's Discussion and Analysis of Financial Condition and Results of Operations – Key Business Metrics – Adjusted EBITDA and Adjusted Net Income (Loss) in the annual report on Form 10-K filed by the Company on March 14, 2017.13, 2018.

| | |

| | |

HDS Notice of Annual Meeting and | | |

GENERAL INFORMATION ABOUT THE |

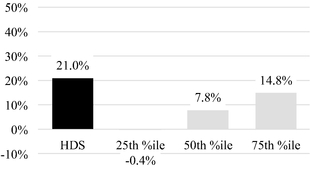

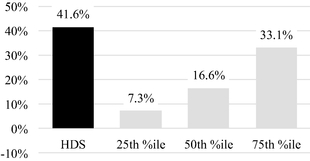

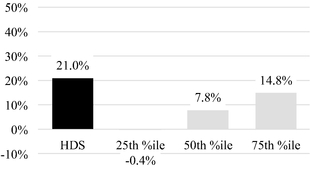

In terms of relative performance, the Company's total stockholder return on a 1-year and 3-year basis has been superior to the Company's industry peers (executive compensation peer group companies):

| ||

|  |

|

|

|

|

|

|

|

|

|

|

Corporate Governance Highlights

| | | |

|---|---|---|

| | | |

| Board Independence | •

| |

| Independent Lead Director | • Our independent directors regularly meet in private executive sessions without management. • We have an independent lead director, who serves as the presiding director at the executive sessions of the independent directors. • All committees of | |

Board Oversight | •

| |

Risk Oversight | • The board has overall responsibility for the oversight of the Company's risk management and reviews our major financial, operational, compliance, reputational and strategic risks, including steps to monitor, manage and mitigate such risks. • Each board committee is responsible for oversight of risk management practices for categories of risks relevant to its functions. | |

Annual Board Assessments | •

| |

Board Refreshment | • The board continues to recruit new directors to bring fresh perspectives and new ideas into our boardroom. • Mr. Dorsman | |

Stockholder Outreach | • Company management has in the past engaged in wide-ranging dialogue with our major institutional investors. Both the Company and the board benefit greatly from the insights, experiences and ideas exchanged during these engagements. We are committed to continuing this dialogue with our stockholders in the future. | |

Board Declassification – Annual Elections | • The board evaluates on an ongoing basis our corporate governance policies. It recently evaluated the current need for a classified board structure and determined that declassification would be in the best interests of the Company and its stockholders. At the Annual Meeting, we are asking our stockholders to approve an amendment to our Certificate of Incorporation and Bylaws to declassify our board and provide for the annual election of directors. | |

Stock Ownership Guidelines and Holding Period Requirements | • We amended our stock ownership guidelines for our independent directors in 2017 to increase the required ownership from three to five times the annual cash board retainer. Our independent directors must now own at least • Our CEO must own at least five times, our CFO and each of our executive officers who is in charge of a principal business unit must own three times, and each other executive officer must own one times, his or her annual base salary in our common stock within the later of five years from the 2013 effective date of the policy or the date he or she becomes an executive officer. All of our named executive officers currently satisfy the stock ownership guidelines. • Our directors and executives must hold 50% of their vested awards until the ownership guidelines are satisfied and, once satisfied, must hold sufficient shares to satisfy the guidelines at all times. | |

Compensation Clawback | • In the event of a significant restatement of financial results, the board may recoup cash incentive bonuses and equity awards granted to our executive officers. | |

Director Orientation and Continuing Education | • We provide orientation for new directors, and provide our directors with materials or briefing sessions on subjects that we believe will assist them in discharging their duties. We also engage third parties to provide either in-boardroom or dinner meeting education to our directors. To supplement the education we provide, we encourage our directors to attend external programs and reimburse up to $5,000 annually for the costs of attending such programs. | |

| | | |

| | |

| | |

| | HDS Notice of Annual Meeting and 2018 Proxy Statement – Page 3 |

GENERAL INFORMATION ABOUT THE 2018 ANNUAL MEETING (continued) |

Proposal 1 – Amendment to Certificate of Incorporation and Bylaws to Declassify the Board of Directors

The board is asking you to approve an amendment to the Company's Second Amended and Restated Certificate of Incorporation ("Certificate of Incorporation") and the Company's Third Amended and Restated By-Laws (the "Bylaws") to declassify our board and allow for the annual election of directors. For more information see pages 67-68.

Proposal 2 – Director Election

The Company currently has nine directors divided into three classes: two directors in Class I, four directors in Class II, and three directors in Class III. The term of office of the Class II directors expires at the Annual Meeting. The Nominating and Corporate Governance Committee reviewed the qualifications, performance and circumstances of each incumbent Class II director. After completing its review, the Committee proposed all incumbent Class II directors for re-election. The board approved the Committee's recommendation regarding the Class II incumbent directors. The education and professional history of the four Class II nominees are provided below.

The four nominees for election as Class II directors are listed below. If our stockholders approve the proposed amendment of our Certificate of Incorporation and Bylaws (see Proposal 1 on pages 67-68) by the requisite vote at the Annual Meeting, then the proposed amendment will become effective immediately upon the filing of the proposed amendment with the office of the Secretary of State of the State of Delaware, which we intend to do during the course of the Annual Meeting, and will apply to the election of directors at the Annual Meeting. If the proposed amendment is approved:

If the proposed amendment is not approved by the stockholders of the Company by the requisite vote at the Annual Meeting, the Company will continue to have a classified board as currently provided for in the Company's Certificate of Incorporation and Bylaws, and, if elected, the nominees will serve for a three-year term and until their successors are elected and qualify.

| | |

| | |

HDS Notice of Annual Meeting and | | |

GENERAL INFORMATION ABOUT THE |

Proposal 1 – Director Election

The Company currently has ten directors divided into three classes: four directors in Class I and three directors in each of Class II and Class III. The term of office of the Class I directors expires at the Annual Meeting. The Nominating and Corporate Governance Committee reviewed the qualifications, performance and circumstances of each incumbent Class I director. After completing its review, the Committee proposed all incumbent Class I directors for re-election except for John W. Alden. Having reached the mandatory retirement age of 75 provided by our Corporate Governance Guidelines, Mr. Alden will not stand for reelection to the board and will retire upon the expiration of his current term at the Annual Meeting. The board approved the Committee's recommendation regarding the Class I incumbent directors. The education and professional history of the three Class I nominees are provided below.

The three nominees for election as Class I directors are listed below. If elected, the nominees for election as Class I directors will serve for a term of three years and until their successors are elected and qualify. If you sign and return the accompanying proxy card, your shares will be voted for the election of the three Class III nominees recommended by the board of directors unless you choose to withhold from voting for any of the nominees. If for any reason any nominee is unable to serve or will not serve, such proxies may be voted for a substitute nominee designated by the board of directors as the proxy holder may determine. The board is not aware of any nominee who will be unable to or will not serve as a director. There is no cumulative voting.

A nominee must receive the vote of a plurality of the votes validly cast at the Annual Meeting represented either in person or by proxy at the Annual Meeting to be elected. Therefore, the threefour nominees who receive the most "FOR" votes (among votes properly cast in person, electronically or by proxy) will be elected. Notwithstanding such election, each of the threefour nominees for election as Class III directors has agreed to tender to the board his or her resignation as a director promptly following the certification of election results in the event such nominee receives a greater number of votes "withheld" from his or her election than votes "for" his or her election (see "Majority Voting Policy – Director Nominees" below for details regarding the board's majority voting policy). Proxies cannot be voted for a greater number of persons than the number of nominees named. The Class III nominees are as follows:

| Name | Age | Director Since | Occupation | Board Committees | Other Public Company Boards | Independent | Age | Director Since | Occupation | Board Committees | Other Public Company Boards | Independent | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | | | | | |

Kathleen J. Affeldt | 68 | 2014 | Retired, Former VP-HR, Lexmark | Compensation Chair | 1 | Yes | ||||||||||||||||||

Peter A. Dorsman | 61 | 2017 | Retired, Former EVP, NCR Corporation | Compensation | 1 | Yes | ||||||||||||||||||

Peter A. Leav | 46 | 2014 | President and CEO, BMC Software | N&CG | 0 | Yes | ||||||||||||||||||

Betsy S. Atkins | 64 | 2013 | CEO, Baja Corporation | Chair N&CG | 3 | Yes | ||||||||||||||||||

Scott D. Ostfeld | 41 | 2017 | Partner, JANA Partners | Compensation | 0 | Yes | ||||||||||||||||||

James A. Rubright | 71 | 2014 | Retired CEO, Rock-Tenn | Audit; N&CG | 0 | Yes | ||||||||||||||||||

Lauren Taylor Wolfe | 39 | 2017 | Founding Partner, Impactive Capital* | Audit; N&CG | 0 | Yes | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

Additional qualifications, experience, and other information about the threefour director nominees, as well as ourthe current boardmembers of directorsthe board who will continue to serve after the Annual Meeting, is provided on pages 21-24.17-21. There are no agreements or arrangements between third parties and any of our

|

|

|

|

|

|

|

|

|

|

directors, including the nominees, which provide for compensation or other payment in connection with the director's candidacy or service as a director.

Majority Voting Policy – Director Nominees

The full text of the board's majority voting policy for director nominees is set forth in the Company's Corporate Governance Guidelines, available on the corporate governance section of our investor relations website athttp://ir.hdsupply.com/governance.cfm.

Each of the threefour nominees for election as Class III directors has agreed to tender to the board his or her resignation as a director promptly following the certification of election results in the event such nominee receives a greater number of votes "withheld" from his or her election than votes "for" his or her election (a "Majority Withheld Vote"). Neither abstentions nor broker non-votes are deemed to be votes for or withheld from a director's election. The Nominating and Corporate Governance Committee will consider any tendered resignation and recommend to the board whether to accept or reject it. The board will act on each tendered resignation, taking into account the Nominating and Corporate Governance Committee's recommendation, at its next regularly scheduled board meeting following the certification of the election results. The Nominating and Corporate Governance

| | |

| | |

| | HDS Notice of Annual Meeting and 2018 Proxy Statement – Page 5 |

GENERAL INFORMATION ABOUT THE 2018 ANNUAL MEETING (continued) |

Committee, when making its recommendation, and the board, when making its decision, may consider any factors or other information that it considers appropriate, including, without limitation, the reasons (if any) given by stockholders as to why they withheld their votes, the qualifications of the tendering director, his or her contributions to the board and the Company, and the results of the most recent evaluation of the tendering director's performance by the Nominating and Corporate Governance Committee and other board members.

The board will promptly and publicly disclose (1) its decision whether to accept or reject the director's tendered resignation, and (2) if rejected by the board, the board's reasons for rejecting the tendered resignation. Any director who tenders his or her resignation will not participate in the Nominating and Corporate Governance Committee recommendation or board action regarding whether to accept or reject the tendered resignation. If a director's tendered resignation is rejected by the board, the director will continue to serve for the remainder of his or her term and until his or her successor is duly elected, or his or her earlier death, resignation or removal. If a director's tendered resignation is accepted by the board, then the board, in its sole discretion, may fill any resulting vacancy or may decrease the number of directors comprising the board, in each case pursuant to the provisions of, and to the extent permitted by, the Company's Third Amended and Restated By-Laws (the "Bylaws").Bylaws.

The board will consider as candidates for nomination for election or reelection to the board, or to fill vacancies and new directorships on the board, only those individuals who agree to tender, promptly following their election, reelection or appointment, an irrevocable resignation that will be effective upon (i) the occurrence of a Majority Withheld Vote for that director and (ii) acceptance of the tendered resignation by the board. Each of the Class III director nominees have signed such an irrevocable resignation.

Proposal 23 – Ratification of the Appointment of the Independent Registered Public Accounting Firm

The board is asking you to ratify its appointment of PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm for the 20172018 fiscal year ending January 28, 2018.

|

|

|

|

|

|

|

|

|

|

February 3, 2019. PricewaterhouseCoopers LLP has served as our independent registered public accounting firm since 2008. Set forth below is summary information with respect to the fees billed to us by PricewaterhouseCoopers LLP for services provided to us during the fiscal years ended January 29, 201728, 2018 and January 31, 2016.29, 2017. For more information, see pages 66-6764-66 and page 70.71.

| Fees Billed | (Fiscal | (Fiscal | ||||

|---|---|---|---|---|---|---|

| | | | | | | |

Audit Fees | | $ | | $ | ||

Audit-Related Fees | $ | $ | ||||

Tax Fees | | $0.5 million | | $ | ||

All Other Fees | ||||||

| | | | | | | |

TOTAL | | $ | | $ | ||

| | | | | | | |

Proposal 3 – Advisory Vote to Approve Named Executive Officer Compensation

The advisory vote gives our stockholders the opportunity to express their views on our named executive officers' compensation, as disclosed in this proxy statement pursuant to Section 14A of the Securities and Exchange Act of 1934 (the "Exchange Act"). While the advisory vote is not binding on the Company, the board and Compensation Committee will take into account the result of the vote when determining future executive compensation arrangements.

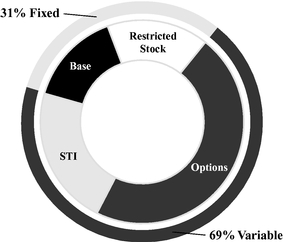

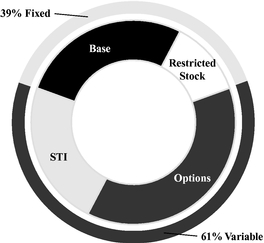

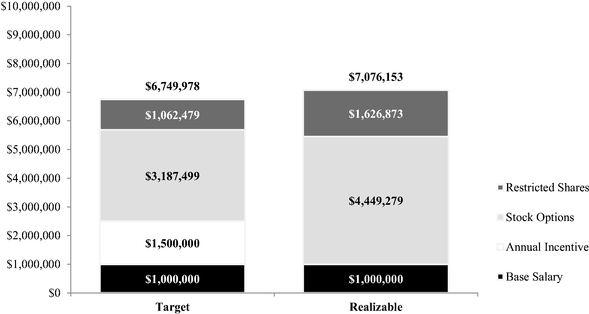

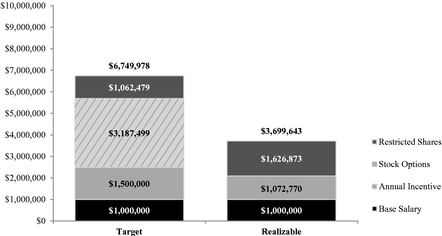

As described in detail in our Compensation Discussion and Analysis set forth below, a core objective of our executive compensation is to enable us to attract, to motivate and to retain talent. We believe that our executive compensation is aligned with pay-for-performance principals and aligns the named executive officer's long-term interests with those of our stockholders. For more information, please read our Compensation Discussion and Analysis beginning on page 41 for details about our executive compensation programs, including information about fiscal 2016 compensation of our named executive officers.

The following table shows the compensation for the following individuals for fiscal 2016. For an explanation of the amounts in the table below, see the "Summary Compensation Table" on page 56 of this proxy statement.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Joseph J. DeAngelo,Chief Executive Officer | | 2016 | | 1,000,000 | | — | | 1,062,479 | | 3,187,499 | | — | | 55,263 | | 5,305,241 | |||||||||

Evan J. Levitt,Chief Financial Officer | 2016 | 461,778 | — | 356,223 | 1,068,745 | 236,607 | 57,553 | 2,180,906 | |||||||||||||||||

Stephen O. LeClair,President, Waterworks | | 2016 | | 442,280 | | — | | 168,730 | | 506,246 | | 232,747 | | 56,455 | | 1,406,458 | |||||||||

Margaret M. Newman,Chief People Officer | 2016 | 423,638 | — | 180,607 | 541,874 | 214,192 | 2,140,295 | 3,500,606 | |||||||||||||||||

John A. Stegeman,President, C&I – White Cap | | 2016 | | 788,677 | | — | | 297,061 | | 891,251 | | 1,133,660 | | 141,224 | | 3,251,873 | |||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Proposal 4 – Approval of Amended and Restated HD Supply Holdings, Inc. Omnibus Incentive Plan

In March 2017, the board approved the Amended and Restated HD Supply Holdings, Inc. Omnibus Incentive Plan, subject to stockholder approval at the Annual Meeting. We are asking our stockholders to approve the plan, including the material terms of the performance goals under which performance-based grants are made, to satisfy the stockholder approval requirement under Section 162(m) of the Internal Revenue Code ("Section 162(m)") so that we may grant awards under the plan

|

|

|

|

|

|

|

|

|

|

that satisfy the requirements for "qualified performance-based compensation" and that qualify for tax deductibility under Section 162(m).

Equity compensation helps us attract and retain the best executive talent who are motivated by pay for performance and enables us to remain competitive for talent. Approval of the plan is critical to our ability to continue our compensation programs, which we believe are aligned with stockholder interests. Our three-year average burn or grant rate is 1.61%, compared to a 2.99% three-year average burn or grant rate for the Russell 3000 (capital goods) benchmark. The overhang from our equity awards is 2.8%, compared to an overhang for our peer group of 2.5% at the 25th percentile; 3.5% at the 50th percentile and 6.2% at the 75th percentile. The plan authorizes an additional 8,335,779 million shares, plus the 6,664,221 million remaining authorized shares under the plan as of the record date, for a total of 15 million shares. The following chart provides the details of the share request:

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

The requested shares should provide us with the ability to grant equity awards for approximately five years, at which time the plan must be resubmitted for stockholder approval under the requirements of Section 162(m). We have included provisions in the plan that we believe protect our stockholders' interests and promote effective corporate governance. For more information, see "Proposal 4 – Approval of Amended and Restated HD Supply Holdings, Inc. Omnibus Incentive Plan" on pages 72-83 of this proxy statement.

Proposal 5 – Approval of HD Supply Holdings, Inc. Annual Incentive Plan for Executive Officers

In March 2017, the board approved the HD Supply Holdings, Inc. Annual Incentive Plan for Executive Officers, our annual cash bonus plan, subject to stockholder approval at the Annual Meeting. We are asking our stockholders to approve the plan, and the material terms of the performance goals under which bonus compensation is to be paid under the plan, to satisfy the stockholder approval requirement under Section 162(m). Stockholder approval will allow the plan to satisfy the requirements for "qualified performance-based compensation" that qualifies for tax deductibility under Section 162(m).

Short-term cash bonus compensation helps us attract and retain the best executive talent who are motivated by pay for performance and enables us to remain competitive for talent. Approval of the plan is critical to our ability to continue our compensation programs that we believe are aligned with stockholder interests. For more information, see "Proposal 5 – Approval of HD Supply Holdings, Inc. Annual Incentive Plan for Executive Officers" on pages 84-88 of this proxy statement.

|

|

|

|

|

|

|

|

|

|

Pursuant to Rule 14a-8 under the Exchange Act, stockholder proposals submitted for inclusion in the proxy statement for our annual meeting of stockholders expected to be held in May 20182019 must be received by us by December 1, 2017.November 30, 2018. For more information, see page 89.72.

| | |

| | |

HDS Notice of Annual Meeting and 2018 Proxy Statement – Page 6 | | |

GENERAL INFORMATION ABOUT THE 2018 ANNUAL MEETING (continued) |

Why am I receiving these proxy materials?

The accompanying proxy materials have been furnished to you because the Company is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement describes issues on which we would like you to vote at our Annual Meeting. It also gives you information on these issues so that you can make an informed decision.

The proxy materials include the notice and proxy statement for the Annual Meeting, our annual report on Form 10-K for the fiscal year ended January 29, 2017,28, 2018, the proxy card for the Annual Meeting, and directions on attending the Annual Meeting. The Company has made these proxy materials available to you by Internet or, upon your request, has delivered printed versions of these materials to you by mail, because you owned shares of Company common stock at the close of business on the March 20, 201721, 2018 record date.

When you vote via the Internet, or by signing and returning the proxy card, you appoint Dan S. McDevitt and James F. Brumsey as your representatives at the Annual Meeting, with full power of substitution. They will vote your shares at the Annual Meeting as you have instructed them or, if an issue that is not on the proxy card comes up for vote, in accordance with their best judgment, and as permitted by applicable law. This way, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we encourage you to vote in advance via Internet, or if you received your proxy card by mail, by signing and returning your proxy card. If you vote via Internet, you do not need to return your proxy card.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the U.S. Securities and Exchange Commission, the Company uses the Internet as the primary means of furnishing proxy materials to stockholders. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the "Notice") to the Company's stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or how to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of its annual meetings and reduce the cost to the Company of physically printing and mailing materials.

Who is entitled to vote?

Holders of our common stock at the close of business on March 20, 201721, 2018 are entitled to vote. March 20, 201721, 2018 is referred to as the record date. In accordance with Delaware law, a list of stockholders entitled to vote at the Annual Meeting will be available in electronic form at the place of the Annual Meeting on May 17, 2018 and will be accessible in electronic form for ten days before the meeting at our principal place of business, 3400 Cumberland Boulevard, Atlanta, Georgia 30339 between the hours of 9:00 a.m. and 5:00 p.m. Eastern Daylight Time.

| | |

| | |

| | HDS Notice of Annual Meeting and |

GENERAL INFORMATION ABOUT THE |

the Annual Meeting on May 17, 2017 and will be accessible in electronic form for ten days before the meeting at our principal place of business, 3100 Cumberland Boulevard, Atlanta, Georgia 30339 between the hours of 9:00 a.m. and 5:00 p.m. Eastern Daylight Time.

Each share of common stock is entitled to how many votes?

Holders of common stock are entitled to one vote per share. On the record date, there were 201,728,780 shares of our common stock outstanding and entitled to vote.

How do I vote?

If you are a registered stockholder, which means you hold your shares (including any restricted shares) in certificate form or through an account with our transfer agent, American Stock Transfer & Trust Company, LLC, you have the following options for voting before the Annual Meeting:

If you are a beneficial holder, meaning you hold your shares in "street name" through an account with a bank or broker, your ability to vote via the Internet or by telephone depends on the voting procedures of your bank or broker. Please follow the directions on the voting instruction form that your bank or broker provides.

Stockholders may also attend the Annual Meeting and vote in person. The method you use to vote will not limit your right to vote at the Annual Meeting if you decide to attend in person. Written ballots will be passed out to anyone who wants to vote at the Annual Meeting. If you hold your shares in "street name," you must obtain a proxy, executed in your favor, from the holder of record to be able to vote in person at the Annual Meeting. Please refer to the notice and voting instruction form, or other information forwarded by your bank or broker, for details on how to request a proxy.

Is my vote confidential?

Confidential voting applies to individual stockholders but not to corporate and institutional stockholders. Our confidential voting policy is set forth in our Corporate Governance Guidelines available athttp://ir.hdsupply.com/governance.cfm.

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. Registered stockholders may do this by:

| | |

| | |

HDS Notice of Annual Meeting and | | |

GENERAL INFORMATION ABOUT THE |

If you hold shares through a bank or broker, please refer to your voting instruction form, or other information forwarded by your bank or broker, to see how you can revoke your proxy and change your vote.

Attendance at the Annual Meeting will not, by itself, revoke a proxy.

How many votes do you need to hold the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast at the Annual Meeting will constitute a quorum. If aA quorum ismust be present we can holdto conduct business at the Annual Meeting and conduct business.Meeting.

On what items am I voting?

You are being asked to vote on fivetwo items:

No cumulative voting rights are authorized, and dissenters' rights are not applicable to these matters.

How does the board of directors recommend that I vote?

The board recommends that you vote:

| | |

| | |

| | HDS Notice of Annual Meeting and |

GENERAL INFORMATION ABOUT THE |

How may I vote for the proposal to amend the Certificate of Incorporation and Bylaws to declassify the board and provide for the annual elections of directors?

With respect to this proposal, you may:

In order to pass, the proposal must receive the affirmative vote of at least 75% of the voting power of the outstanding shares as of the record date. If you abstain from voting on the proposal, it will have the same effect as a vote against the proposal.

How may I vote in the election of directors, and how many votes must the nominees receive to be elected?

With respect to the election of directors, you may:

The Company's Bylaws provide for the election of directors by a plurality of the votes cast. This means that the threefour individuals nominated for election to the board of directors who receive the most "FOR" votes (among votes properly cast in person, electronically or by proxy) will be elected. Notwithstanding such election, each of the threefour nominees for election as Class III directors has agreed to tender to the board his or her resignation as a director promptly following the certification of election results if he or she receives a greater number of votes "withheld" from his or her election than votes "for" his or her election (see "Majority Voting Policy – Director Nominees" on page 6pages 5-6 for details regarding the board's majority voting policy).

What happens if a nominee is unable to stand for election?

If a nominee is unable to stand for election, the board may either:

If the board designates a substitute nominee, shares represented by proxies voted for the nominee who is unable to stand for election will be voted for the substitute nominee.

How may I vote for the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

In order to pass, the proposal must receive the affirmative vote of a majority in voting power of the shares entitled to vote at the Annual Meeting by the shares present in person, electronically, or by

| | |

| | |

HDS Notice of Annual Meeting and | | |

GENERAL INFORMATION ABOUT THE |

proxy and entitled to vote. If you abstain from voting on the proposal, it will have the same effect as a vote against the proposal.

How may I vote on the proposal to approve, on an advisory basis, the executive compensation of the named executive officers as disclosed in this proxy statement, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

In order to pass, the proposal must receive the affirmative vote of a majority in voting power of the votes that could be castshares entitled to vote at the Annual Meeting by the shares present in person, electronically, or by proxy and entitled to vote. If you abstain from voting on the proposal, it will have the same effect as a vote against the proposal.

How may I vote on the proposal to approve the Amended and Restated HD Supply Holdings, Inc. Omnibus Incentive Plan, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

In order to pass, the proposal must receive the affirmative vote of a majority of the votes that could be cast at the Annual Meeting by the shares present in person, electronically, or by proxy and entitled to vote. If you abstain from voting on the proposal, it will have the same effect as a vote against the proposal.

How may I vote on the proposal to approve the HD Supply Holdings, Inc. Annual Incentive Plan for Executive Officers, and how many votes must this proposal receive to pass?

With respect to this proposal, you may:

In order to pass, the proposal must receive the affirmative vote of a majority of the votes that could be cast at the Annual Meeting by the shares present in person, electronically, or by proxy and

|

|

|

|

|

|

|

|

|

|

entitled to vote. If you abstain from voting on the proposal, it will have the same effect as a vote against the proposal.

What happens if I sign and return my proxy card but do not provide voting instructions?

If you return a signed card but do not provide voting instructions, your shares will be voted as follows:

Will my shares be voted if I do not vote via the Internet, telephone, by signing and returning my proxy card, or by attending the Annual Meeting and voting in person?

If you do not vote via the Internet, by telephone (certain beneficial stockholders), by signing and returning your proxy card, or by attending the Annual Meeting and voting in person, then your shares will not be voted and will not count in deciding the matters presented for stockholder consideration at the Annual Meeting.

Under certain circumstances and in accordance with NASDAQ rules that govern banks and brokers, if your shares are held in street name through a bank or broker, your bank or broker may vote your shares if you do not provide voting instructions before the Annual Meeting. These circumstances include voting your shares on "routine matters," such as the ratification of the appointment of our independent registered public accounting firm described in this proxy statement. With respect to this proposal, therefore, if you do not vote your shares, your bank or broker may vote your shares on your behalf or leave your shares unvoted.

The remaining four proposals, namely amendment of our Certificate of Incorporation and Bylaws and the election of director nominees, the advisory approval of named executive officer compensation, approval of the Amended and Restated HD Supply Holdings, Inc. Omnibus Incentive Plan, and approval of the HD Supply Holdings, Inc. Annual Incentive Plan for Executive Officers, are not considered routine matters under NASDAQ rules relating to voting by banks and brokers. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a "broker non-vote." Broker non-votes at the Annual Meeting will be counted for purposes of establishing a quorum, but will have no effect on the outcome of the non-routine mattersproposals being voted on at the Annual Meeting.

We encourage you to provide instructions to your bank or brokerage firm by voting your proxy. This action ensures your shares will be voted at the meeting in accordance with your wishes.

|

|

|

|

|

|

|

|

|

|

What is the vote required for each proposal to pass, and what is the effect of abstentions and uninstructed shares on the proposals?

For the proposal to amend our Certificate of Incorporation and Bylaws to declassify the board and provide for the annual elections of directors, the proposal must receive the affirmative vote of at least 75% of the voting power of the outstanding shares as of the record date. Our Bylaws provide for the election of directors by a plurality of the votes cast. This means that the threefour individuals nominated for election to the board of directors who receive the most "FOR" votes (among votes properly cast in person, electronically or by proxy) will be elected. Notwithstanding such election, each of the threefour nominees for election as Class I directors has agreed to tender his or her resignation as a director to the board promptly following the certification of election results if he or she receives a greater number of votes "withheld" from his or her election than votes "for" his or her election (see "Majority Voting Policy – Director Nominees" on page 6pages 5-6 for details regarding the board's majority voting policy). For each of the other proposalsproposal to ratify our independent registered public accounting firm to pass in accordance with our Bylaws, the proposal must receive the affirmative vote of a majority of the votes that could be cast at the Annual Meeting by the shares present in person, electronically, or by proxy at the Annual Meeting and entitled to vote. The

| | |

| | |

| | HDS Notice of Annual Meeting and 2018 Proxy Statement – Page 11 |

GENERAL INFORMATION ABOUT THE 2018 ANNUAL MEETING (continued) |

following table summarizes the board's recommendation on each proposal, the vote required for each proposal to pass, and the effect abstentions or uninstructed shares (proxy card returned, but voting instructions not provided) have on each proposal.

| Proposal Number | Item | Board Voting Recommendation | Votes Required for Approval | Abstentions | Broker Non- Votes | Uninstructed Shares | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | ||||||

| 1 | Amendment of Certificate of Incorporation and Bylaws | FOR | 75% of the voting power of the outstanding shares as of the record date | Count as votes against | No effect | Count as votes FOR | |||||||||||||

| 2 | Election of Directors | FOR | The | Not applicable | No effect | For all board nominees | |||||||||||||

| Ratification of independent registered public accounting firm | FOR | Majority of the voting power of the shares present in person, electronically, or by proxy and entitled to vote | Count as votes against | Not applicable | Count as votes for ratification | ||||||||||||||

| | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

What do I need to attend the Annual Meeting in person?

You must bring your admittance ticket (the Notice of Internet Availability of Proxy Materials that you received in the mail), proof of your share ownership as of March 20, 201721, 2018 (such as a brokerage statement or letter from your broker), and government-issued photo identification (such as a driver's license). If you do not have an admittance ticket, proof of ownership, or a valid photo identification, you will not be admitted to the Annual Meeting. Cameras and recording devices are not permitted at the meeting. All bags, briefcases, and packages will be held at registration and will not be allowed in the meeting.

Can I receive future proxy materials and annual reports electronically?

Yes. This proxy statement and our annual report on Form 10-K for our fiscal 20162017 year ended January 29, 201728, 2018 are available by accessing the website located athttp://www.astproxyportal.com/ast/18392/. Instead of receiving paper copies in the mail, stockholders can elect to receive an email that provides a link to our future annual reports and proxy materials on the Internet. Opting to receive your proxy materials electronically will save us the cost of producing and mailing documents to your home or business, will reduce the environmental impact of our annual meetings, and will give you an automatic link to the proxy voting site.

If you are a stockholder of record and wish to enroll in the electronic proxy delivery service for future meetings, you may do so by going tohttp://www.astproxyportal.com/ast/18392/ and following the prompts. If you hold shares through a bank or broker, please refer to the notice and voting instruction form, or other information forwarded by your bank or broker, to see how you can enroll for electronic proxy delivery for future meetings.

| | |

| | |

HDS Notice of Annual Meeting and | | |

OUR EXECUTIVE OFFICERS |

The following table sets forth certain information concerning our executive officers. The respective age of each individual in the table below is as of March 31, 2017.30, 2018.

| Name | Age | Position | |||

|---|---|---|---|---|---|

| | | | | | |

Joseph J. DeAngelo | | Chairman, President and Chief Executive Officer | |||

Evan J. Levitt | Senior Vice President, Chief Financial Officer and Chief Administrative Officer | ||||

| |||||

Dan S. McDevitt | | General Counsel and Corporate Secretary | |||

| |||||

John A. Stegeman | Executive President, HD Supply; President, HD Supply Construction & Industrial - White Cap | ||||

William P. Stengel II | | 40 | President and Chief Executive Officer, HD Supply Facilities Maintenance | ||

Stephen O. LeClair | 49 | Former President, HD Supply Waterworks (through August 1, 2017 divestiture of Waterworks business) | |||

| | | | | | |

Joseph J. DeAngelo has served asChairman, President and Chief Executive Officer since March 2015, President and Chief Executive Officer since January 2005, and has been a member of our board since August 2007. Mr. DeAngelo served as Executive Vice President and Chief Operating Officer of The Home Depot from January 2007 through August 2007. From August 2005 to December 2006, he served as Executive Vice President — HD Supply. From January 2005 to August 2005, Mr. DeAngelo served as Senior Vice President — Home Depot Supply, Pro Business and Tool Rental, and from April 2004 through January 2005, he served as Senior Vice President — Pro Business and Tool Rental. Mr. DeAngelo previously served as Executive Vice President of The Stanley Works, a tool manufacturing company, from March 2003 through April 2004. From 1986 until April 2003, Mr. DeAngelo held various positions with General Electric ("GE"). His final position with GE was President and Chief Executive Officer of General Electric TIP/Modular Space, a division of General Electric Capital. Mr. DeAngelo holds a bachelor's degree in accounting and economics from the State University of New York at Albany. Mr. DeAngelo serves on the board of directors of Owens-Illinois, Inc., the board of trustees of the Shepherd Center Foundation, the Advisory Board of Combat Marine Outdoors, and the CEO Advisory Council of the Cristo Rey Atlanta Jesuit High School.

Evan J. Levitt has served asSenior Vice President, Chief Financial Officer since December 2013 and asChief Administrative Officer since January 2017. Prior to his appointment as Chief Financial Officer, he served as Vice President and Corporate Controller of HD Supply since 2007 when he joined the Company from The Home Depot, where he was the Assistant Controller and Director of Financial Reporting from 2004 to 2007. He also served in various management roles at Payless ShoeSource from 1999-2004, including Vice President of Accounting and Reporting. Prior to Payless ShoeSource, he held the role of Audit Manager with Arthur Andersen. Mr. Levitt has a bachelor of science in business administration from Washington University and is a Certified Public Accountant.

Stephen O. LeClair has served asPresident, HD Supply Waterworks since August 2011, and served as Chief Operating Officer, HD Supply Waterworks from March 2008 through August 2011. He served as President of HD Supply Lumber and Building Materials from April 2007 until its divestiture in March 2008. Mr. LeClair joined the HD Supply team in October 2005 as Senior Director of Operations and served in that role through April 2007. Before joining HD Supply, he served as Senior Vice President at GE Equipment Services. He also held various roles at GE Appliances and Power Generation in distribution, manufacturing and sales. Mr. LeClair is a graduate of GE Power Generation's Manufacturing Management Program. He is a member of the Saint Louis University's International Business School Advisory Board. He holds a bachelor's degree in Mechanical Engineering from Union College and an M.B.A. degree from the University of Louisville.

|

|

|

|

|

|

|

|

|

|

Dan S. McDevitt has served asGeneral Counsel and Corporate Secretary since January 2015. He joined HD Supply's legal department in 2010 and was promoted to Vice President in 2012. Prior to joining HD Supply, Mr. McDevitt was a partner at the law firm King & Spalding, where he practiced law for thirteen years, primarily focused on securities and corporate governance litigation and related investigations. Before joining King & Spalding, Mr. McDevitt served as a judicial clerk for the Honorable G. Ernest Tidwell on the United States District Court, Northern District of Georgia, and before then was an associate at Sullivan, Hall, Booth, & Smith. Mr. McDevitt received a B.B.A. degree in finance from the University of Notre Dame and a J.D. and LL.M. from the University of Notre Dame Law School.

| | |

| | |

| | HDS Notice of Annual Meeting and 2018 Proxy Statement – Page 13 |

joined HD Supply in April 2007 as Director, Human Resources, was promoted to Vice President, Human Resources in October 2007, and served asSenior Vice President, Chief People Officer from June 2008 through January 29, 2017. Prior to HD Supply, Ms. Newman held senior human resources leadership roles at Conseco Insurance Group from August 2005 to April 2007, and at Sears Roebuck and Company from September 1997 to August 2005. She has more than 20 yearsTable of business experience in the manufacturing industry, building her expertise in organizational effectiveness; acquisition and integration; benefits design; talent acquisition and management; leadership development and employee engagement. Ms. Newman holds a bachelor's degree in psychology from Coe College and a master's degree in sociology from the University of Wisconsin.Contents

OUR EXECUTIVE OFFICERS (continued) |

John A. Stegeman joined HD Supply in April 2010 asExecutive President and focused on building the specialty construction and safety business as thePresident of HD Supply Construction & Industrial – White Cap. Prior to joining HD Supply, Mr. Stegeman was President and Chief Executive Officer of Ferguson Enterprises, headquartered in Newport News, Virginia from 2005 to 2009. He began his career with Ferguson in 1985 as a management trainee and advanced through the company holding various management positions in three of Ferguson's five business groups: Waterworks, Plumbing, and Heating and Air Conditioning. As part of the Ferguson Waterworks business group, Mr. Stegeman served as Senior Vice President before being named Chief Operating Officer of Ferguson in May 2005. Mr. Stegeman received a bachelor's degree from Virginia Tech and has attended advanced management programs at Wharton School of Business, IMD, Duke University's Fuqua School of Business, University of Virginia Darden School of Business, and Columbia University.

The following senior leadership team employees are not executive officers, but are expected to make significant contributions to our business. The respective age of each individual in the table below is as of March 31, 2017.

| |||||

| |||||

William P. Stengel, age 39, has served as President and Chief OperatingExecutive Officer for of HD Supply Facilities Maintenance since June 2017. He served as Chief Operating Officer for HD Supply Facilities Maintenance from August 2016. Prior2016 to his current role, he servedJune 2017; as Senior Vice President, Chief Commercial Officer of HD Supply Facilities Maintenance from January 2016 to August 2016 and2016; as Senior Vice President, Strategic Business Development and Investor Relations of HD Supply from July 2013 through January 2016. Mr. Stengel held the role of2016; and as Vice President, Strategic Business Development from June 2010 to July 2013. In his current role, Mr. Stengel has responsibility for end-to-end supply chain, merchandising, global

|

|

|

|

|

|

|

|

|

|

sourcing, marketing, e-business, corporate development and strategic initiative execution at HD Supply Facilities Maintenance. He joined HD Supply in July 2005 and has since taken on increasing leadership roles at the Company across corporate development, strategic planning and initiatives, supply chain operations, real estate, investor and public relations, communications, marketing, e-commerce and digital execution. Mr. Stengel and his teams have responsibility to drive strategic growth and operational excellence. He has 20 years of experience in finance and growth strategy. In addition, he has led numerous acquisition and divestiture transactions and contributed in a leadership role in the initial public offering of HD Supply in June 2013. Prior to joining HD Supply in 2005, Mr. Stengel worked for Stonebridge Associates, an investment banking firm focused on merger and acquisition divestiture, private placement, and strategic financial advisory services to middle-market companies across a range of consumer, technology, and industrial sectors. He also worked in corporate and investment banking with Bank of America Merrill Lynch. Mr. Stengel holds a bachelor's degree in economics from Trinity College (CT) and an M.B.A. degree with a concentration in strategy and finance from Vanderbilt University's Owen Graduate School of Management.

Stephen O. LeClair served asPresident, HD Supply Waterworks from August 2011 through the Company's August 2017 divestiture of its HD Supply Waterworks business, and currently serves as Chief Executive Officer of Core & Main. He served as Chief Operating Officer, HD Supply Waterworks from March 2008 through August 2011. He served as President of HD Supply Lumber and Building Materials from April 2007 until its divestiture in March 2008. Mr. LeClair joined the HD Supply team in October 2005 as Senior Director of Operations and served in that role through April 2007. Before joining HD Supply, he served as Senior Vice President at GE Equipment Services. He also held various roles at GE Appliances and Power Generation in distribution, manufacturing and sales. Mr. LeClair is a graduate of GE Power Generation's Manufacturing Management Program. He is a member of the Saint Louis University's International Business School Advisory Board. He holds a bachelor's degree in Mechanical Engineering from Union College and an M.B.A. degree from the University of Louisville. Mr. LeClair serves on the board of directors of AAON, Inc.

Anna Stevens, age 44,45, isVice President, Human Resources and Chief People Officer for HD Supply. In thisher role as Chief People Officer, she oversees all of our human resources professionals across the organization and in multiple functional areas including benefits, recruiting, compensation, organizational development and learning, talent management, strategy, project management, mergers and acquisitions, human resources systems and technologies, payroll and community affairs. With nearly 20 years of experience in human resources management, Ms. Stevens has extensive expertise in communications and change management, human resources strategic planning, staffing, development and succession planning, coaching and performance management. She joined HD Supply in 2008,

| | |

| | |

HDS Notice of Annual Meeting and 2018 Proxy Statement – Page 14 | | |

OUR EXECUTIVE OFFICERS (continued) |

working in the areas of organizational development, learning and communications before being promoted to Vice President, HR Strategy, Marketing and Communications in 2012 and Vice President, HR Planning and Operations in 2014. Prior to joining HD Supply, Ms. Stevens served in various roles of increasing responsibility for AT&T, Inc. Preceding AT&T, Ms. Stevens held human resources management roles at Progressive, Inc., Bell South and Aerotek Inc. Ms. Stevens holds a bachelor's degree in international relations from Lynchburg College and a master's degree in organizational leadership from Gonzaga University.

| | |

| | |

| | HDS Notice of Annual Meeting and |

OUR BOARD OF DIRECTORS |

The Company's Certificate of Incorporation provides that the board shall consist of not fewer than three nor more than 21 directors, with the exact number to be fixed by the board. The board has fixed the current number of directors at ten,nine, and the Company currently has tennine directors. Mr. Alden's term will end on the date of the Annual Meeting, and, having reached the mandatory retirement age of 75 provided by our Corporate Governance Guidelines, he will retire from board service and will not stand for reelection at the Annual Meeting. The board has fixed the number of directors at nine effective with Mr. Alden's retirement on May 17, 2017.

The Company's Certificate of Incorporation divides the board into three classes, as nearly equal in number as possible, with the terms of office of the directors of each class ending in different years. Class I currently has two directors, Class II has four directors, and Class II and Class III each havehas three directors. The terms of directors in Classes I, II, and III end at the annual meetings in 2017,2020, 2018, and 2019, respectively. There will be three Class I directors upon Mr. Alden's retirement on May 17, 2017.

| Director | Class | |||

|---|---|---|---|---|

| | | | | |

| Kathleen J. Affeldt | Class I | – Expiring | ||

| Peter A. Dorsman | Class I | – Expiring | ||

| Betsy S. Atkins | Class II | – Expiring 2018 Annual Meeting | ||

| Scott D. Ostfeld | Class II | – Expiring 2018 Annual Meeting | ||

| James A. Rubright | Class II | – Expiring 2018 Annual Meeting | ||

| Lauren Taylor Wolfe | Class II | – Expiring 2018 Annual Meeting | ||

| Joseph J. DeAngelo | Class III | – Expiring 2019 Annual Meeting | ||

| Patrick R. McNamee | Class III | – Expiring 2019 Annual Meeting | ||

| Charles W. Peffer | Class III | – Expiring 2019 Annual Meeting | ||

| | | | | |

At each annual meeting of the stockholders, the successors of the directors whose term expires at that meeting are elected to hold office for a term expiring at the annual meeting of stockholders held in the third year following the year of their election. The board of directors is therefore asking you to elect the threefour nominees for director whose term expires at the Annual Meeting. Kathleen J. Affeldt, PeterBetsy S. Atkins, Scott D. Ostfeld, Lauren Taylor Wolfe, and James A. Dorsman and Peter A. Leav,Rubright, our Class III directors, have been nominated by the board for reelection at the Annual Meeting. See "Proposal 12 — Election of Directors" on page 69.pages 69-70.

If our stockholders approve the proposed amendment of our Certificate of Incorporation and Bylaws (see Proposal 1 on pages 67-68) by the requisite vote at the Annual Meeting, then the proposed amendment will become effective immediately upon the filing of the proposed amendment with the office of the Secretary of State of the State of Delaware, which we intend to do during the course of the Annual Meeting, and will apply to the election of directors at the Annual Meeting. If the proposed amendment is approved:

| | |

| | |

HDS Notice of Annual Meeting and 2018 Proxy Statement – Page 16 | | |

OUR BOARD OF DIRECTORS (continued) |

The proposed amendment also provides that any director elected to fill a vacancy will hold office for the term that remains for that director, and any director elected to fill a vacancy that resulted from an increase in the size of the board will be elected to serve until the next annual meeting.

Directors are elected by a plurality. Therefore, the threefour nominees who receive the most "FOR" votes will be elected. Notwithstanding such election, each of the threefour nominees for election as Class III directors has agreed to tender to the board his or her resignation as a director promptly following the certification of election results if he or she receives a greater number of votes "withheld" from his or her election than votes "for" his or her election (see "Majority Voting Policy – Director Nominees" on page 6pages 5-6 for details regarding the board's majority voting policy).

Proxies cannot be voted for a greater number of persons than the number of nominees named. There is no cumulative voting. If you sign and return the accompanying proxy card, your shares will be voted for the election of the threefour nominees recommended by the board unless you choose to withhold from voting for any of the nominees. If a nominee is unable to serve or will not serve for any reason, proxies may be voted for such substitute nominee as the proxy holder may determine. The Company is not aware of any nominee who will be unable to or will not serve as a director.

Set forth below is biographical information as well as background information relating to each nominee's and continuing director's business experience, qualifications, attributes, and skills and why

|

|

|

|

|

|

|

|

|

|

the board and Nominating and Corporate Governance Committee believe each individual is a valuable member of our board. The persons who have been nominated for election and are to be voted upon at the Annual Meeting are listed first, with continuing directors following thereafter.

Nominees: | ||||||||

| | | | | | | | | |

Betsy S. Atkins, Chief Executive Officer, Baja Corporation | Age 64 | Class II — term expiring at 2018 Annual Meeting Committees: N&CG (Chair) | Director since 2013 | |||||

Background: Ms. Atkins has served as chief executive officer of Baja Corporation since 1991. She served as chairperson of APX Labs, LLC (now Upskill), a Google Glass/Smart Glass enterprise software company from 2013 to 2016. She served as president and chief executive officer of Baja Ventures, an independent venture capital firm focused on the technology, renewable energy, and life sciences industry, from 1991 through 2008. From 2008 through 2009, Ms. Atkins served as chief executive officer and chairperson of Clear Standards, Inc., which developed enterprise level energy management and sustainability software, prior to its sale to SAP AG. She previously served as chairperson and chief executive officer of NCI, Inc., a food manufacturer creating Nutraceutical and Functional Food products, from 1991 through 1993. Ms. Atkins co-founded Ascend Communications, a manufacturer of communications equipment, in 1989, where she was also a member of the board of directors until its acquisition by Lucent Technologies in 1999. Ms. Atkins currently serves on the board of directors of Schneider Electric, SA (April 2011 – present), SL Green Realty Corp (April 2015 – present), and Cognizant Technology Solutions Corporation (April 2017 – present). She also serves on the board of directors of a number of private companies, including Volvo Car Corporation (January 2016 – present). She has extensive public board experience, including most recently, Polycom, Inc. (1999-2016), Darden Restaurants, Inc. (2014-2015), Ciber, Inc. (2014), Wix.com Ltd. (2013-2014); and Chico's FAS, Inc. (2004-2013). She holds a bachelor's degree from the University of Massachusetts. | ||||||||

Director Qualifications: Ms. Atkins has significant entrepreneurial, senior management, and operational experience, with deep technology expertise in cyber, mobile, social, and digital transformation. She also brings to the board extensive knowledge in the areas of executive compensation and corporate governance. | ||||||||

| | | | | | | | | |

| | |

| | |

| | HDS Notice of Annual Meeting and 2018 Proxy Statement – Page 17 |

OUR BOARD OF DIRECTORS (continued) |

| | | | | | | | | |

Scott D. Ostfeld,Partner, JANA Partners | Age 41 | Class II — term expiring at 2018 Annual Meeting Committees: Compensation | Director since 2017 | |||||

Background: Mr. Ostfeld is a partner of JANA Partners where he is co-portfolio manager of the JANA Strategic Investments Fund and is responsible for special situations investments, including active stockholder engagement. Prior to joining JANA in 2006, Mr. Ostfeld was with GSC Partners in their distressed debt private equity group focused on acquiring companies through the bankruptcy restructuring process and enhancing value as an active equity owner. Prior to GSC Partners, Mr. Ostfeld was an investment banker at Credit Suisse First Boston where he worked on a variety of M&A and capital raising assignments. Mr. Ostfeld was a member of the board of directors of Team Health Holdings, Inc. from March 2016 to February 2017. He serves on the nonprofit boards for Columbia University's Richman Center for Business, Law, and Public Policy and The Opportunity Network Mr. Ostfeld received a J.D. from Columbia Law School, an M.B.A. from Columbia Business School and a B.A. from Columbia University. | ||||||||

Director Qualifications: Mr. Ostfeld has extensive experience investing in companies and engaging with them to help improve stockholder value, as well as with capital allocation, strategy and governance. His knowledge and experience brings valuable insight to the board. The age diversity that Mr. Ostfeld brings to the board also further enhances the diversity of experience, backgrounds and opinions represented on the board. | ||||||||

| | | | | | | | | |

James A. Rubright,Retired CEO, Rock-Tenn Co. | Age 71 | Class II — term expiring at 2018 Annual Meeting Committees: Audit; N&CG | Director since 2014 | |||||

Background: Mr. Rubright served as chief executive officer of Rock-Tenn Co. from 1999 until his retirement in October 2013, and served as an executive officer of Sonat, Inc. from 1994 to 1999 in various capacities, including head of Sonat's interstate natural gas pipeline group and energy marketing businesses. Prior to 1994, he was a partner in the law firm of King & Spalding. Mr. Rubright has served as a member of the board of directors of Southern Company Gas, an energy services holding company, since 2016. He previously served as a member of the board of directors of Forestar Group, Inc., a real estate and natural resources company, from 2007 until 2017; AGL Resources, Inc., from 2001 to 2016; Avondale, Incorporated, the parent company of Avondale Mills, Inc., from 2003 to 2008, and as chairman of Rock-Tenn's board from 2000 until his retirement in October 2013. He holds a bachelor of arts degree from Yale College and a juris doctor degree from the University of Virginia Law School. | ||||||||

Director Qualifications: Mr. Rubright has significant experience in public company management and board leadership, and a deep understanding of operations, strategy, and risk management that provides valuable insight to our board. | ||||||||

| | | | | | | | | |

Lauren Taylor Wolfe,Founding Partner, Impactive Capital | Age 39 | Class II — term expiring at 2018 Annual Meeting Committees: Audit; N&CG | Director since 2017 | |||||

Background: Ms. Taylor Wolfe is the founding partner of Impactive Capital, an impact-oriented investing firm, effective April 2018. She served as a managing director and investing partner of Blue Harbour Group, an activist investment firm that engages collaboratively with management teams and boards to enhance stockholder value, from December 2007 through January 2018. Prior to joining Blue Harbour Group in 2007, she was a portfolio manager and analyst at SIAR Capital where she invested in small capitalization public and private companies. From 2000 to 2003, Lauren worked at Diamond Technology Partners, a strategic technology consulting firm. She received a master's degree in business administration from The Wharton School at University of Pennsylvania in 2006 and a bachelor of science degree from Cornell University in 2000. | ||||||||

Director Qualifications: Ms. Taylor Wolfe has expertise in capital allocation, capital markets and financial analysis and experience across various industries including information technology, consumer, industrials, and business services. Her diverse knowledge and experience across various industry verticals and expertise in capital allocation and long-term value investing brings valuable insight to the board. The age and gender diversity that Ms. Taylor Wolfe brings to the board also further enhances the diversity of experience, backgrounds and opinions represented on the board. | ||||||||

| | | | | | | | | |

| | |

| | |

HDS Notice of Annual Meeting and 2018 Proxy Statement – Page 18 | | |

OUR BOARD OF DIRECTORS (continued) |

Continuing Directors: | ||||||||

| | | | | | | | | |

Kathleen J. Affeldt,Retired, Former Vice President, Human Resources, Lexmark International | Age | Class I — term expiring at 2020 Annual Meeting Independent Lead Director Committees: Compensation (Chair) | Director since 2014 | |||||

Background: Ms. Affeldt began her career at IBM in 1969, specializing in sales of supply chain systems. She later held a number of human resources management positions at IBM and joined Lexmark as a director of human resources in 1991 when it was formed as a result of a buy-out from IBM. Ms. Affeldt previously served on the board, and as chair of the compensation committee, of SIRVA, Inc. from August 2002 to May 2007 and Sally Beauty Holdings, Inc. from November 2006 to November 2013. She also served on the board of Whole Health, Inc. from 2004 to 2006. Ms. Affeldt currently serves on the board, and as chair of the compensation committee, of NCI Building Systems, Inc. since November 2009, and as chair of the board of BTE Technologies, Inc. since May 2004. Ms. Affeldt majored in business administration at the State University of New York and Hunter College. She has also participated in numerous technical and leadership development programs, as well as the executive education program at Williams College. | ||||||||

Director Qualifications: Ms. Affeldt's board leadership and expertise in the human resources field and executive compensation, coupled with her operations history, strong business acumen, and public company experience, provides valuable insight to the board. | ||||||||

| | | | | | | | | | ||

Peter A. Dorsman,Retired, Former EVP, Global Services, NCR Corporation | Age | Class I — nominee for election at 2020 Annual Meeting Committees: Audit; Compensation | Director since 2017 | |||||||